VAT explained

Value Added Tax (VAT) is a secondary tax that is charged on the consumption of goods and services in the economy. In the context of medical practitioners, VAT is charged on the consumption of your services (the provision of healthcare). This means that a portion of your revenue is paid to SARS as VAT. This is known as output VAT and is how SARS collects their VAT revenue.

Reducing my taxable income

Input VAT is an allowance which you can claim to reduce the output VAT payable to SARS. You can reduce your output VAT payable to SARS by claiming input VAT on your practice expenses, which includes your medical malpractice insurance premiums paid to local insurance companies.

How is this achieved?

By choosing a South African medical malpractice insurance offering, you can claim the VAT back on this payment to reduce your output VAT payable.

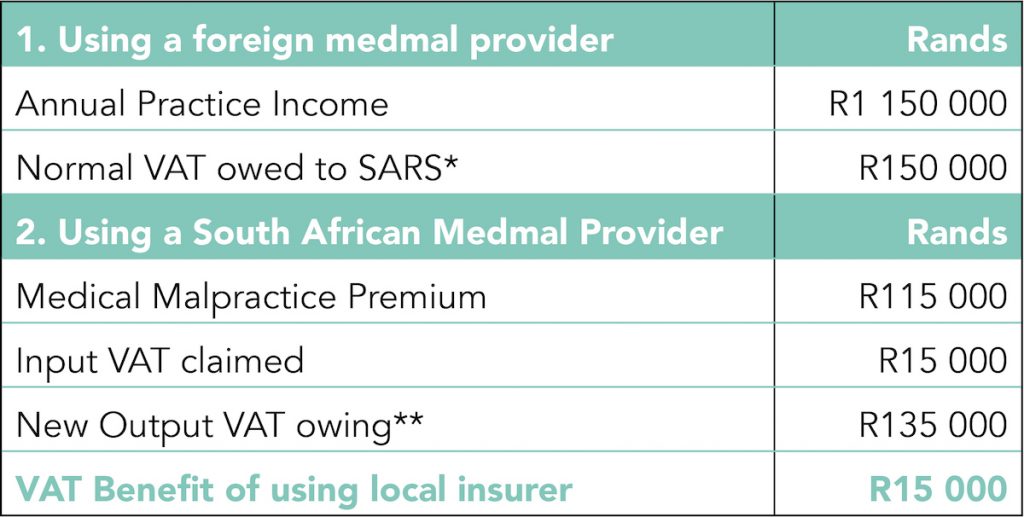

The below is an example for illustration purposes only

*As the practice income includes VAT at 15%, this is owed to SARS

** Since you can claim 15% of the insurance premium,

you pay R15 000 less in VAT for the year

Subscribe now

Share this article

Read More

More Articles

How to become a business rescue practitioner in South Africa

Embarking on the journey to become a Business Rescue Practitioner (BRP) in South Africa is a pathway filled with challenges, but also immense opportunities to make a significant impact in the corporate landscape. As the country navigates through economic fluctuations and business uncertainties, the role of a BRP has become increasingly vital. This article serves…

Can I Get Retroactive Coverage With Professional Indemnity Insurance?

Short Answer: Yes, you can get retroactive cover. It’s important to note that various insurers may have distinct criteria or prerequisites concerning retroactive cover and dates. You should canvass this with your broker prior to taking out a PI policy. Retroactive cover is an important aspect of Professional Indemnity (PI) insurance. This type of cover…

Which Professions Require Professional Indemnity Insurance?

While this list is not exhaustive, here are some professions in South Africa that commonly require PI insurance: It is important to note that the requirement for PI insurance may vary based on regulatory bodies, professional associations, contractual obligations, and client demands within each profession. Professionals in these fields should consult with their respective industry…